Vacancy tax as a lever against soil sealing?

On April 3, the review period for an amendment to the constitution that would make it easier for the nine federal states to introduce a levy on vacant residential properties ended. One day before the deadline expired, Greenpeace presented a current calculation that shows the following: around 230,000 apartments and houses in Austria are vacant. This could easily cover the entire housing needs of the city of Graz. At the same time, around 60,000 new apartments are being built every year, thus concreting over fertile land. Greenpeace is calling for a vacancy tax to be introduced as soon as possible and implemented by the federal states.

The new draft law contains an added clause stating that laws on public housing are a matter for the federal government, "but not the levying of public charges for the purpose of avoiding non-use or under-use". According to ORF, the data situation on vacant residential properties is difficult. There are no official data in this regard, but Statistics Austria regularly compares the number of all residential units in Austria with the population register and, according to ORF, recently came up with around 650,000 residential properties where no one is registered - almost three times as many as the Greenpeace calculation showed. This is partly due to the fact that the figure also includes vacation homes offered for rent, apartments that are vacant for a short time between two rentals and allotment garden houses.

An absurd, environmentally harmful system

Melanie Ebner, soil protection spokesperson at Greenpeace: "There are thousands of empty apartments in Austria. At the same time, hectares of fertile land are being built on and enormous amounts of resources are being used to create new living space. This is an absurd, environmentally damaging system that primarily benefits real estate speculators."

"This is already painful and helps against the hoarding of apartments," Amann from the Institute for Real Estate, Building and Housing (IIBW) told ORF.at. According to Amann, giving the federal states more powers, as announced, would make the vacancy tax instrument more effective and have a mobilizing effect.

Based on the available data and studies on housing construction and vacancy rates, Greenpeace has calculated that

- around 230,000 apartments with

- 17.4 million square meters of residential space are vacant.

- At the same time, an average of 60,000 new apartments are built each year.

By contrast, the population is growing much more slowly than the newly built living space:

- While this grew by 6.3 percent in the period from 2011 to 2021,

- residential space has almost doubled (12.4 percent) in the same period.

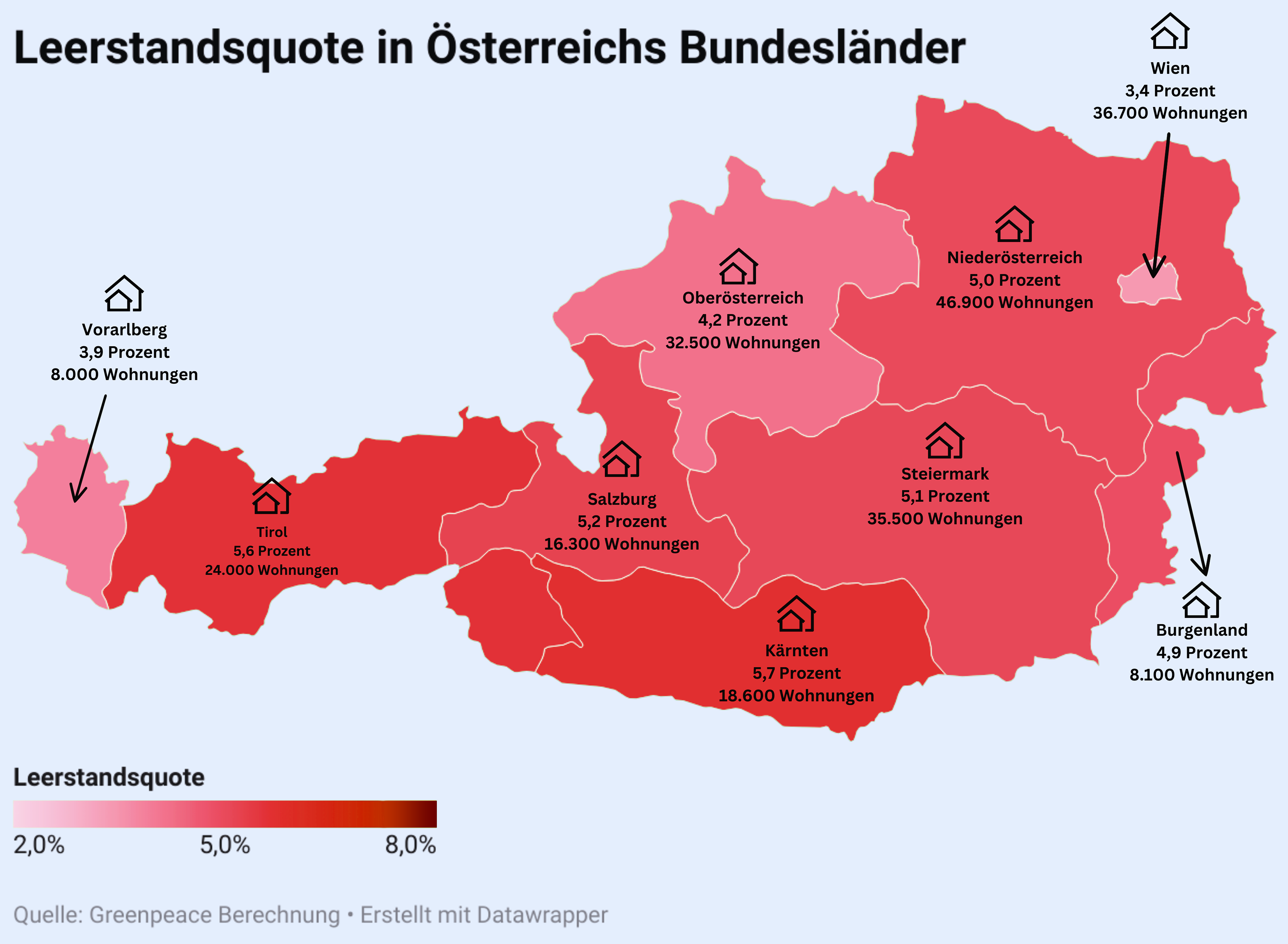

Vacancy rates at a glance

The average vacancy rate in Austria is 4.7 percent.

The highest vacancy rates are found in

- Carinthia (5.7 percent),

- Tyrol (5.6 percent) and

- Salzburg (5.2 percent).

The lowest vacancy rates have

- Vienna with 3.4 % and

- Vorarlberg with 3.9 percent.

According to the Greenpeace survey, 11.5 percent of all apartments in Austria are registered as secondary residences - and are therefore also temporarily vacant. The highest rates of secondary residences are in

- Burgenland,

- Lower Austria

- Salzburg

The French model

The French model shows how efficiently a vacancy tax can counteract unused living space, says Greenpeace in its press release: The vacancy tax introduced in France in 1999 was able to reduce the number of vacancies by 13 percent from its introduction until 2013. Applied to Austria, this would correspond to around 40,000 apartments being occupied again. According to the environmental organization, the tax proceeds from a vacancy tax could then be used to finance urgently needed renovation measures. "If vacant apartments and sporadically used second homes were reactivated, we could save up to 4,170 hectares of land for new buildings - that's roughly the total amount of land Austria uses in a year," says Ebner. Greenpeace is calling on the federal states to implement a mandatory vacancy tax, including a secondary residence tax, as soon as the legal basis has been agreed.

Our pro.earth.conclusion:

The topic of soil sealing often occupies us in the editorial team. We see the enormous importance and how little progress is being made in this area. On the one hand, we consider zoning at municipal level to be highly problematic because everyone looks at their own little empire instead of the big picture. A vacancy tax at state level could also lose sight of the big picture, but should in principle be considered as a possible control instrument - but only in combination with other far-reaching measures to protect our land and our food security.